Finding the path to Financial Literacy

How technology helped me. And how it led me astray a few times.

Note: Apologies for the delay in posting. I took a break to attend and help conduct a wedding! Thank you so much for being with me and reading my posts!

Like most young people from the Indian Middle Class I had little understanding of money beyond saving enough to pay rent and to cover other essentials. In my family, we were used to living on the edge and were paycheck to paycheck for much of my childhood. Not to say that I lacked anything, of course, I was still definitely more privileged than most. But I do regret never learning about personal finance and even the basics of budgeting through my home.

When I arrived in the US for my graduate studies (with a huge loan to boot) I still didn’t think too much about it. I would work part-time or pull money from a personal loan to cover my expenses. I didn’t budget. I didn’t save. One month, I had 20 dollars left in my account and I remember darkly joking about it with my sister. I didn’t know that I needed an SSN to get a credit card, or how it's needed to lease apartments, or even to open a basic savings account. I guess that’s my first lesson for anyone moving to the US: Get an SSN and build your credit history. Without that, your financial growth will be sorely limited.

All through my graduate studies my financial status was a constant source of worry. I was thinking about it even when I wasn’t thinking about it. I think anyone with a student loan and without a job can empathize. In fact, only a year or two into my first job did I relax. And only after I paid back my student loan did I even start thinking about money.

One of the first things I did was to get a high yield savings account. These are usually the ones available online from Amex, Marcus, etc. and not the ones available through your normal bank account, i.e, Chase, BoFa, etc. At the time the interest rate was 1-2% and I remember being super impressed by that amount (Now in 2023, it’s more like 4-5%).

I also knew that I should “invest”. But I had no idea what that meant. Invest in what? Where? How? I didn’t know where to start and looking it up online was scary and I doubted what the best first steps were. It was 2020, and about that time Crypto exploded. Being young and foolish, I thought that since the current financial system was broken anyway, I should just dive into crypto which seemed more future-friendly.

But yes, I learnt my lesson. Thankfully, I didn’t put too much money in. Crypto was my first experience with investing and what a volatile way it was to start. I created accounts on Coinbase and BlockFi. Now, the first one is struggling and the other is basically defunct. The financial media, celebrities and insta influencers all combined to promote crypto. I didn’t even realize that I may be giving away my money to join the lowest layer of a massive Ponzi scheme. Reddit did little to moderate its content as well. HODL1 to the moon indeed.

I think I may have lost close to a 1000 USD in total. Compared to others, it’s not much but still a lot to my poor middle class heart. Once the news cycle changed and crypto slowly lost its sheen, I pulled out most of the money that I had kept in my crypto savings account. Thankfully, I managed to do it right before Blockfi declared bankruptcy. I still have some ETH and BTC, as I can’t help but hold out some hope for the future of crypto in my techie heart. More importantly, this experience helped wake me up from my financial slumber and pushed me to learn more about the current system.

Next, I started looking more into traditional ways of money management. I customized a Google sheets template and finally created a budget. Budgeting is a tedious job for sure, but it's a one-time effort with a huge pay-off. I wished I had learned to do it earlier. Just seeing the money come in and go out and more importantly, how, helped me gain a better understanding of how I was living my life. The data showed me that I was spending way too much on rent and eating out. It also showed that I was buying more clothes than I needed and falling for one too many subscription services.

Budgeting helped me distinguish between my wants vs needs. Did I really need another pair of sneakers? Ans: No! Could I put aside an extra 250 dollars into my savings account? Ans: Yes! I realized that I could cut down on unnecessary spending and instead redirect my money towards saving and investing. Until then, I had reasoned that I didn’t have enough money to invest. I should just wait until I earn more, etc. But I learnt then, and my experience later as a Financial Coach at WMMs2 cemented the fact that it didn’t matter how much you earn. What matters is what you do with that money. A person who earns 50k and one who earns 90k can end up with the same bank balance at the end of the day.

I will try to summarize some of the most important lessons I learnt through my own financial literacy journey:

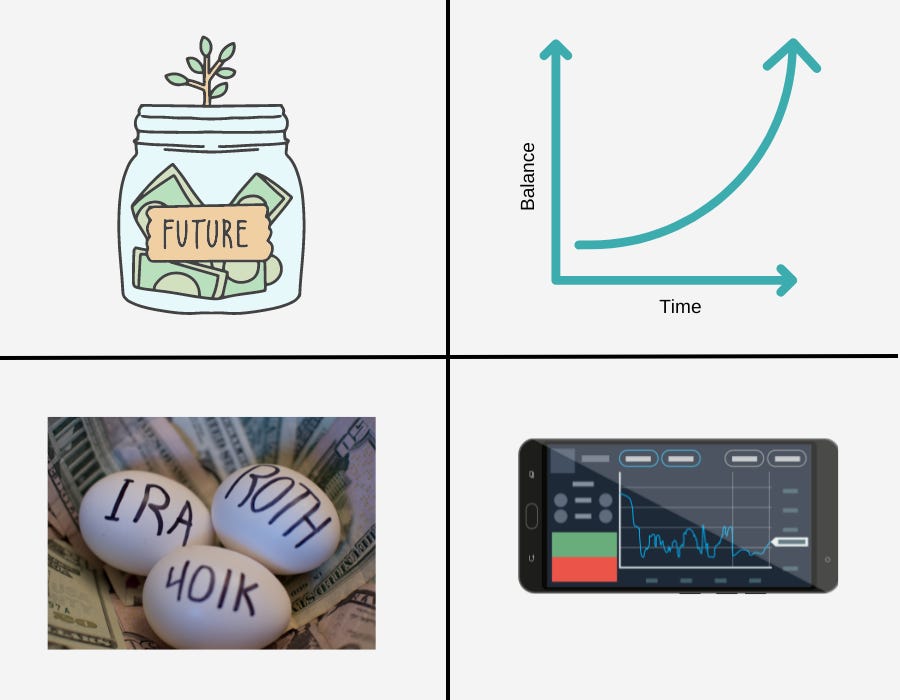

Money makes money.

Honestly, when I first learnt this fact, it blew my mind. I was probably in my early-20s when I first discovered that this is how the rich stay rich without having to slog.The Beauty of Compound Interest.

The earlier you start investing, the more your money will grow. And here’s the chart finance people love to share but it did make an impact on how I was thought about investing.Robo-Investing Apps and Diversification.

If you’re like me and hesitant to handle a brokerage account or god-forbid deal with finance bros, this is a good option to consider. These apps automatically choose a diverse portfolio according to your comfort level and preferences and you can even connect it to your bank account to automatically invest some money every month. Very hands-off.High-Yield Savings Account

As I mentioned earlier, having a HYSA is a good way to passively increase your savings without losing access to your money. I also learnt that one can also open high-interest CDs if you have some money to spare.Employer Benefits: Please avail of the company 401k match!

Or whatever retirement / savings scheme that your company contributes to. HSAs are a good option as well. Make sure to check your employee benefits and to make good use of them! It took me 3 years to realize this.Paying it Forward.

If you can, try to budget a portion of your income for your favorite cause. I discovered that as we get settled into adult life and worrying about our own families, we tend to give lesser importance to causes that had previously captured our attention. Moreover, giving to charity has a lot of tax benefits. (Another tip I learnt from the rich!)

Lastly, the most important lesson I learnt is that it's never too late. Some amount of work and research is needed but the pay-off is well worth it. I was laid-off last month but I am still not worried about money (*fingers crossed) because of the financial choices I had been making for the past year. I’ve also met wonderful women through my volunteering organization who made admirable strides towards financial independence irrespective of their current circumstances. I have discovered a love for financial planning and literacy, not just for its potential to make money but also for the intangibles it gives us: independence, safety, better health outcomes and being able to take care of our loved ones.

Most of my research was done through Google. And investment blogs. I try to cross-verify what I learn by checking multiple sources or reaching out and asking my friends who work in finance for help. It’s time we all started talking about money! (Especially women.)

Hold on For Dear Life

Women’s Money Matters (Great org, please check them out!)- https://womensmoneymatters.org/